Plug and play

MCI's wireless strategy connects

By Jason Meyers

November 11, 1996

A historical examination of MCI's involvement in the

wireless

marketplace could lead some to write the company off

as too meager to

matter.

After all, MCI gave up its cellular holdings to McCaw

in 1985, and

those properties later became part of the AT&T empire.

MCI's plan for

a wireless consortium that it would oversee was rejected

by the

Federal Communications Commission. A strategy to invest

in Nextel

faltered and was ultimately abandoned. And last year,

MCI shied away

from the personal communication services licensing process

from which

Sprint and AT&T emerged as the primary beneficiaries.

But just as it appeared that wireless might not be

in MCI's cards, the

carrier has unleashed a tactical plan proving it is

intent on taking

wireless by storm.

"We have done a number of things on strategy since

we envisioned this

two years ago," said Whitey Bluestein, vice president

of wireless

strategy and development at MCI Communications.

In May 1995, MCI acquired Nationwide Cellular, the

country's largest

cellular reseller, and began offering MCI-branded service

a month

later. In August, the carrier announced resale deals

with five major

cellular operators. That put the carrier in 27 U.S.

cellular markets

with 124 potential customers.

And earlier this year, MCI struck a 10-year, 10-billion-minute

deal

with NextWave to interconnect its landline network to

NextWave's PCS

networks and resell minutes of use, adding an additional

63 potential

markets and 110 million pops.

"The NextWave deal really laid out the next generation

of wireless

service for us," said Bluestein. "It was really

the vision we had for

wireless from the get-go."

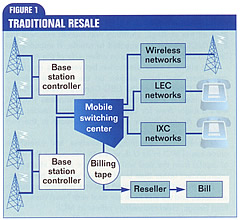

The distinguishing mark of that vision is interconnection.

Traditional

resellers or wireless service can only repackage service

and integrate

billing. (Figure 1).

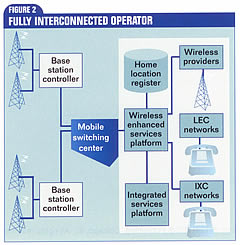

By connecting its wireline base to the switches and

RF portion of

NextWave's networks, MCI controls not only billing but

also service

differentiation via its intelligent network. (Figure

2).

"We stepped back and said, 'There are going to

be a lot of people out

there with facilities. Let's spend the money on something

we already

do well: our intelligent network and infrastructure,'"

said Bluestein.

"With full interconnection, we can look very much

identical to a

facilities-based provider."

That includes being able to offer components such as

operator, 800

number and calling card services, in addition to virtual

private

network services. The carrier bundles its wireless offerings

into its

MCI One package for consumers and networkMCI One bundle

for

businesses. Over the past six years, MCI has invested

more than $2.5

billion in its integrated services platforms, Bluestein

said.

For all that, the capital expense for MCI lies primarily

in the terms

it negotiated with NextWave for interconnection. "The

network

architecture is virtually unchanged from what we had

three or four

years ago when we were talking about the consortium,"

Bluestein said.

One industry analyst who has followed MCI's wireless

saga said he

questioned the resale/interconnection strategy when

MCI first

announced it but that events since have changed his

mind.

"It looks like it was a pretty good move,"

said Peter Gibson,

president of the communications services division of

Trecom Business

Systems. "Companies paid so much for their licenses

that they're going

to want to get money back quickly." Arrangements

like the one NextWave

and MCI formed is one way to accomplish that, he said.

And the NextWave deal is not the end of MCI's wireless

road. The

carrier plans to strike deals with other PCS providers

- most likely

additional C block operators or those that emerge from

the current D,

E and F block auctions. NextWave's code division multiple

access

technology (CDMA) choice is a strong indicator that

other

interconnection deals would be with CDMA providers,

but Bluestein

didn't rule out the possibility of other technologies.

He also noted

that technology at that stage is not the overriding

issue.

"The luxury of the strategy we have is that we

don't have to

participate in the religious wars about air interfaces,"

he said.

COPYRIGHT 1996 PRIMEDIA Business

Magazines & Media Inc. All rights reserved.

|